The results are in – Keynes was right, contractionary economics was wrong, but the damage is done (Evan Soltas)

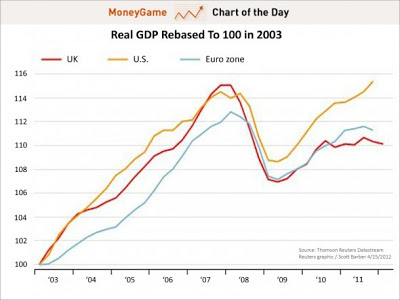

(From Business Insider, April 2012. This graph updated an October 2011 US/UK comparison, here, which already showed the US economic recovery pulling ahead significantly, despite unremitting Republican sabotage and obstructionism. The contrasts are even stronger now ... as shown by the graph at the end of this post.)

A piece by Evan Soltas in Bloomberg News is titled "After Austerity". (In the special vocabulary of economic-policy shorthand, "austerity" policies are those that respond to economic downturns by slashing public spending, trying to reduce government deficits, etc.) Alas, that assessment may be premature, in part for reasons that the piece itself suggests.

But it does capture the dawning realization, glimmerings of which are now beginning to emerge as a nascent consensus in pundit-land, that the advocates of using neo-Keynesian counter-cyclical policies to respond to the Great Recession have been proved right, and the contractionary economic policies pushed by Republicans and right-wing economic pundits in the US, along with an astonishing range of experts as well as politicians in Europe, have turned out to be disastrously wrong (as predicted).

The high tide for Keynesian fiscal stimulus came in 2008 and 2009. Panicked governments spent, spent and spent to stem the financial crisis and avoid a depression. But as economies stabilized in 2010 and 2011, governments began to worry about public debt. Enter the austerians. They pressed for fiscal consolidation -- and got their way. One has to look back to the 1940s and 1950s, as nations demobilized from World War II and the Korean War, to see a comparably rapid tightening.In the US, of course, most proponents of debt hysteria and urgent deficit-cutting also favor cutting taxes. The basic error, shared by US Republicans and British Conservatives (among others), is the failure to recognize that when the economy is still recovering from a major recession, the national government should be running a deficit (except when very special circumstances make that impossible).

Now, though, the intellectual case for austerity is on its way out -- at least in its vulgar form of immediate cuts to public spending and sharp increases in taxes.

Part of the change comes from the implosion of a central claim in an academic paper by Harvard economists Carmen Reinhart and Kenneth Rogoff. They found that nations stop growing when their ratio of public debt to gross domestic product passes a threshold of 90 percent. Their findings were exhibit A for advocates of austerity.But while the Reinhart/Rogoff debacle is the kind of attention-getting incident that makes news, its significance shouldn't be over-hyped. It's really of secondary importance.

Their claim has now been debunked by new analyses finding calculation errors, data omissions, questionable methods and inconclusive evidence of causality. Other high-profile arguments for austerity -- such as recent papers by Alberto Alesina and Silvia Ardagna,, and by David Greenlaw and three others -- have also been criticized.

The case for austerity is coming apart for another and more important reason: The results are in, and they're terrible [my bolding], especially where central banks have failed to offset the fiscal cuts with monetary easing. The International Monetary Fund called for less austerity in a meeting last week. Among the Group of 20 nations, many governments have eased their targets for debt reduction and called for new efforts to boost growth. [....]Unfortunately, it's not at all clear whether, how soon, or to what extent this dawning realization will actually help generate less destructive policies.

What comes next, however, isn’t clear. Don't expect a clean break. Some austerity is already locked in: Gradual fiscal tightening will occur as recovery dampens "automatic stabilizers" such as unemployment insurance and food stamps. [....]And more to the point, the political conditions for more sensible and constructive policy responses to the ongoing Great Recession are not encouraging. In Europe (where a lot of countries are far from even incipient recovery), the framework for EU-wide economic policy-making is notoriously dysfunctional for a range of reasons. Here in the US, fundamentally, the Republicans are the problem. In particular, thanks largely to the benefits of gerrymandering, the House of Representatives is in the grip of know-nothing Tea Party Republicans whose determination to sabotage any possibility of economic recovery seems limitless and impervious to evidence or argument ... and the Senate Republicans have proved themselves capable of historically unprecedented and ever-escalating levels of indiscriminate and almost monolithic obstructionism.

However, a necessary first step in a better direction is for significant sectors of the conventional wisdom to recognize that the overall story about the 2008 crash and its aftermath told, broadly, by the neo-Keynesians (recently summed up, once again, by the invaluable Paul Krugman) has turned out to be, at the very least, much more correct than the story told by their opponents. Perhaps that may be starting to happen?

Hoping for the best,

Jeff Weintraub

<< Home